Are you making decisions off of impartial data?

August 8, 2017

Are you making decisions off of impartial data?

Could you improve your analysis of borrower risk by leveraging more types of data?

In this latest Moody’s Analytics article, Dr. Douglas Dywer discusses how to increase the accuracy of probability of default (PD) calculations for both small firms and medium-sized enterprises by considering a combination of both financial and behavioral data.

In this latest Moody’s Analytics article, Dr. Douglas Dywer discusses how to increase the accuracy of probability of default (PD) calculations for both small firms and medium-sized enterprises by considering a combination of both financial and behavioral data.

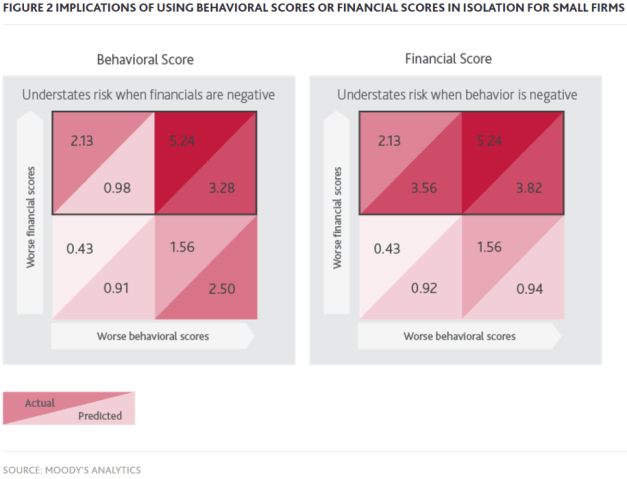

Arguably, behavioral data should be more heavily weighted in the assessment of small firms whose financial data is often incomplete or inaccurate. Carrying out risk decisions using a model based on one form of data alone is shown to result in an overestimate or understatement of the actual PD. Making risk decisions based on partial information can lead an institution to take a loss on a bad loan or spend too much time on the origination process and thus lose business.

The future of lending will likely involve automated approaches to collecting both financial statement information and behavioral information for small firms. The facilitated collection of this data will enable lenders to use both types of information to make better and more informed credit decisions. Learn how to combine both types of information into a better assessment of credit risk in the full Risk Perspective’s article now.