C-Suite Wednesday – Small Business Financing Reached $1.3 Trillion in 2020

February 23, 2022

Delaney Sexton

Contributing Editor

C-Suite Wednesday – Small Business Financing Reached $1.3 Trillion in 2020

“Small businesses borrow mainly for four reasons: to start a business, purchase inventory, expand, or to strengthen the firm’s financial health,” reads the SBA Office of Advocacy’s Small Business FAQ. “The financing needs of small businesses vary greatly by employer and non-employer firms and by age and industry.”

Here are the key statistics:

•37% of employer firms sought financing in 2020.

•Only 37% of employer firms received the full amount applied for in 2020.

•19% of new small businesses use a bank loan for startup capital.

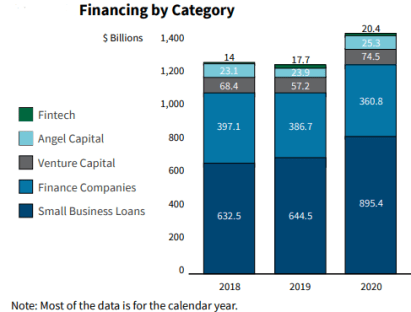

•The small business financing market funded $1.4 trillion in 2020.

•Of small businesses that used bank financing, nearly half of them obtained a loan of $50,000 or more.

•75% of small business owners that applied for credit received financing. In 2020, 37% of applicants received the full amount requested.

•Over 90% of small businesses applied for emergency funding during the pandemic. 82% of employer firms applied for a PPP loan.

•SBA certified depository lenders distributed 93% of the PPP funds.

•In 2020, the year-to-year small business default rate was 3.3% in October, and in October 2021, the default rate decreased to 2.1%.