SBA Hot Topic Tuesday – SBA Inspector General Issues Report on EIDL Fraud

May 18, 2021

Caity Roach

Editor

SBA Hot Topic Tuesday – SBA Inspector General Issues Report on EIDL Fraud

On May 6, 2021, the SBA Office of Inspector General (OIG) issued an evaluation report on the handling of identify theft in the COVID-19 Economic Injury Disaster Loan (EIDL) program. According to the report, as of January 31, 2021, the SBA had referred over 846,000 fraudulent EDIL applications to the OIG, many of which were linked to identity theft complaints.

On May 6, 2021, the SBA Office of Inspector General (OIG) issued an evaluation report on the handling of identify theft in the COVID-19 Economic Injury Disaster Loan (EIDL) program. According to the report, as of January 31, 2021, the SBA had referred over 846,000 fraudulent EDIL applications to the OIG, many of which were linked to identity theft complaints.

Of the 846,000 potentially fraudulent EIDL applications, the SBA confirmed that they had fully disbursed 112,196 loans totaling $6.2 billion and 98,613 Advance Grants worth $468 million. Upon further investigation, the SBA OIG found bank account numbers for 29,435 of the fully disbursed loans were changed from the original number submitted on the application to another number before disbursement (an indicator of fraud).

At the time of the SBA OIG’s review, the SBA had not yet created a process to maintain and track identity theft complaints related to EIDL applications. As a result, the SBA OIG’s data on identity theft complaints was distorted. To address this issue, the SBA OIG made the following recommendations:

- Develop a process to maintain and track all identity theft complaints;

- Develop a process to provide status updates to each complainant alleging identity theft;

- Complete and formalize a process to restore identity theft victims to their condition prior to the fraud. The process should include steps to stop the loan billing statements, prevent delinquency collections, release them from loan liability and UCC liens;

- Develop a process to remove any fraudulent loans and related UCC filing fees from its financial records; and

- Review over 150,000 returned billing statements and resolve any that involve identity theft, then refer fraudulent loans to OIG.

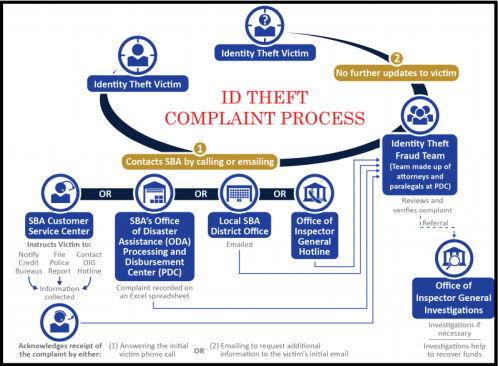

Luckily, the SBA was already aware of these issues prior to the OIG’s evaluation. On February 2, 2021, the SBA implemented a process to maintain, track, and repair cases of identify theft. Based on this updated system, the SBA says that it has determined that less than 0.7% of all EIDL loan application activity is related to identity theft. However, cases of suspected EIDL identity theft should still be reported to IDTheftRecords@sba.gov.

Additional instructions on reporting EIDL identity theft is available online at http://www.sba.gov/eidl-id-theft.

Sources:

OIG Report