Main Street Monday – More Business Equity is Related to Higher Net Worth

August 23, 2021

Delaney Sexton

Contributing Editor

Main Street Monday – More Business Equity is Related to Higher Net Worth

“A substantial amount of family wealth is in business ownership. On average, the self-employed are wealthier than the non-self-employed. This implies the value or potential value of business ownership in economic mobility,” reads the SBA Office of Advocacy’s recent report.

Here are the main points about the importance of business ownership to wealth:

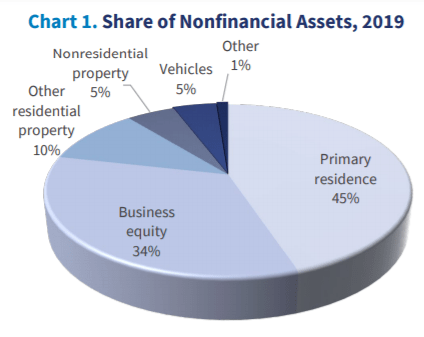

• Nonfinancial assets make up 58% of total assets according to the report. Of the nonfinancial assets, business equity represents 34% of those nonfinancial assets and primary residence is 45% of nonfinancial assets.

• As net worth increases, so does the probability of business equity. 45% of families in the top 10% have business equity, 23% of families in the 75-89th percentile have business equity, and 14% for the 50-74th percentile.

• Self-employed families have a higher median net worth of $380k, more than four times that of families of workers and over twice as much as families with retirees.

• Families that are not self-employed have a median net worth of $122k and a mean of $747k. Self-employed families, those amounts increase to a median net worth of $380k and a mean of $2.7 million.

• For White families, business equity takes up a larger portion of nonfinancial assets at one out of every three dollars. For Black and Hispanic families, business equity decreases to one out of every eight dollars.

• The median net worth for families is $122k. White families’ median net worth increases to $189k. The median net worth then decreases to $75k for multiple-race families, $36k for Hispanic families, and $24k for Black families.