SBA Hot Topic Tuesday — SBA 7(a) Voluntary Prepayments Expected to Increase Slowly in 2017 and 2018

December 6, 2016

By Bob Coleman

Editor, SBA Hot Topic Tuesday

SBA 7(a) Voluntary Prepayments Expected to Increase Slowly in 2017 and 2018

Download the presentation slides here!

Presentation by Bob Judge

2016 SBA Secondary Market Summit

Washington, D.C.

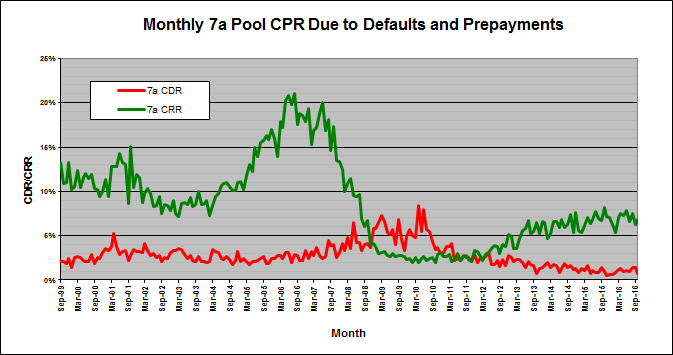

Well, this is a chart that I track, I also put it in my CPR report every month. What it does is it takes the monthly prepayment speeds for 7(a) and divides them between default rates and voluntary payoff rate. As we can see from here defaults have been extremely low for going on three years now. So we’ve had extremely low defaults in the program and, of course, John will talk more about specifics there, but defaults have been under control for quite a period of time. We are beginning to see voluntary prepayments start to rise and as you can see historically that it’s really – voluntary prepayments are the danger zone from an investor’s perspective because of the investor’s indifference to whether a loan voluntarily pays off or defaults.

Lenders care more about default rates than voluntary payoffs, but in this venue we’re talking about the sum of the two which is the overall prepayment rate or CPR. So this is the time in ’06 to ’07 where we had obviously an extremely high overall prepayment speed, well over 20 percent, and it was pretty much all based upon a very high voluntary prepayment speed. Right around here you’re talking about – this was the credit crisis time when voluntary prepayments fell to below 2 or 3 percent annualized per year. Defaults picked up, approached 8 percent per year and then defaults plummeted and now it started a voluntary prepayment.

So right around this timeframe we’re talking about a 5 percent overall prepayment speed which the average for the life of the program is around 12 percent, so we had an extremely low prepayment timeframe. This was a great time to own 7(a) paper with a premium for IOs and things like that. Since we’ve hit that low we’ve slowly started to creep up again mostly because voluntaries are starting to rise. This chart here shows the change – the overall prepayment speed per year since 2012 and the percent change per year. So as we can see in 2012 we had a sub-6 percent. This was the second lowest on record, 2011 was even lower. Then we’ve been slowly creeping up little by little until a little bit below 8 percent for the last couple of years.

One good thing to note is that the increase has been – the percentage increase has been declining year-over-year, so in 2013 we were up almost 29 percent over the previous year. It went down to plus 8 percent. Now we went from 2.6 to this year only just barely above 2015. So the good news it seems that prepayments are rising, but at a slowing rate. So what this is likely going to do is mean that we’re not going to get to a 10 percent CPR any time soon, so it could take a couple of more years. It’s still a very, very good time to own 7(a) paper and pay a prepayment for it.

One of the danger zones in voluntary prepayments is the steepness of the yield curve. The idea being that a borrower will consider exiting a floating rate loan if it can go into a fixed rate as long as his increase in the interest rate is not that big because they want the certainty of their payments over time. They will do that and pay up a little bit, but not when it gets a little bit too crazy. So what I did here was I showed the spread between one-month LIBOR and five-year LIBOR swap versus the voluntary prepayment speed. As we can see when the spread – when a yield curve steepens right here you start to see lower voluntary prepayment speeds. Again this idea being that going into a fixed rate would mean simply too high of an increase in the borrower’s rate. Once we see the swap spreads – they spread between a one-month and a five-year decline, somewhere around a zero percent rate, then you start seeing the significant increase in voluntary prepayments.

So this is really where, in my opinion, when we start seeing under normalized conditions of credit and things like that as long as the banking industry doesn’t have too tight a credit, when we start seeing movements in the steepness of the curve that could have an impact. Right now this is voluntary prepayments again slightly increasing. But we’re still pretty low as far as the steepness of the yield curve, so we’re somewhere around 60 basis points between the one-month and the five-year rate. In my opinion and other people might have a different opinion, but I don’t see any reason why [unintelligible 00:05:11] starting to steepen because right now short-term rates should start to rise hopefully. We were discussing this at the table that the feds should move this this month which will allow the short-end to start coming up.

The five-year, seven-year has been moving higher especially since the election, but there really isn’t any reason – the industry doesn’t think that inflation’s going to be a problem and things like that in the future, so we don’t really expect to see a steep yield curve any time soon. So that’s one – again a good benefit from a voluntary prepayment rate is that that shouldn’t really have too much of an impact, a very flat yield curve on voluntary prepayments. And the conclusion on my side of it right here I think that prepayments again steadily increase over the next couple of years. I don’t think we’ll get to 10 percent for another couple of years, so again this is a period of time where we’re still below the overall average of around 12 percent and again a good time to be investing in premium 7(a) paper.